Nuvve Provides Second Quarter 2023 Financial Update

Investor Conference Call to be Held Today at 5:00 PM Eastern Time (2:00 PM PT)

San Diego (Aug 10, 2023) /PRNewswire/ —Nuvve Holding Corp. (Nasdaq: NVVE), a green energy technology company that provides a globally-available, commercial vehicle-to-grid (V2G) technology platform that enables electric vehicle (EV) batteries to store and resell unused energy back to the local electric grid and provides other grid services, today provided a second quarter 2023 update.

Second Quarter Highlights

- Introduced Astrea AI forecasting into the Nordic energy market to optimize revenue generation from ancillary market services

- Launched Nuvve K-12, a new division focused on turnkey electrification services for student transportation, and hired new team to build out the program

- Secured Nuvve’s largest DC Fast Charger order to-date with 25 bi-directional DC Rapid HD Charging Stations for a member of Beacon Mobility in Massachusetts

- Reduced cash operating costs in second quarter 2023 to $7.3 million compared $8.3 million in second quarter 2022

- Megawatts under management increased 9.0% to 20 megawatts as of June 30, 2023 compared to 18.3 megawatts on March 31, 2023; backlog increased to $6.1 million at June 30, 2023 from $4.2 million on March 31, 2023

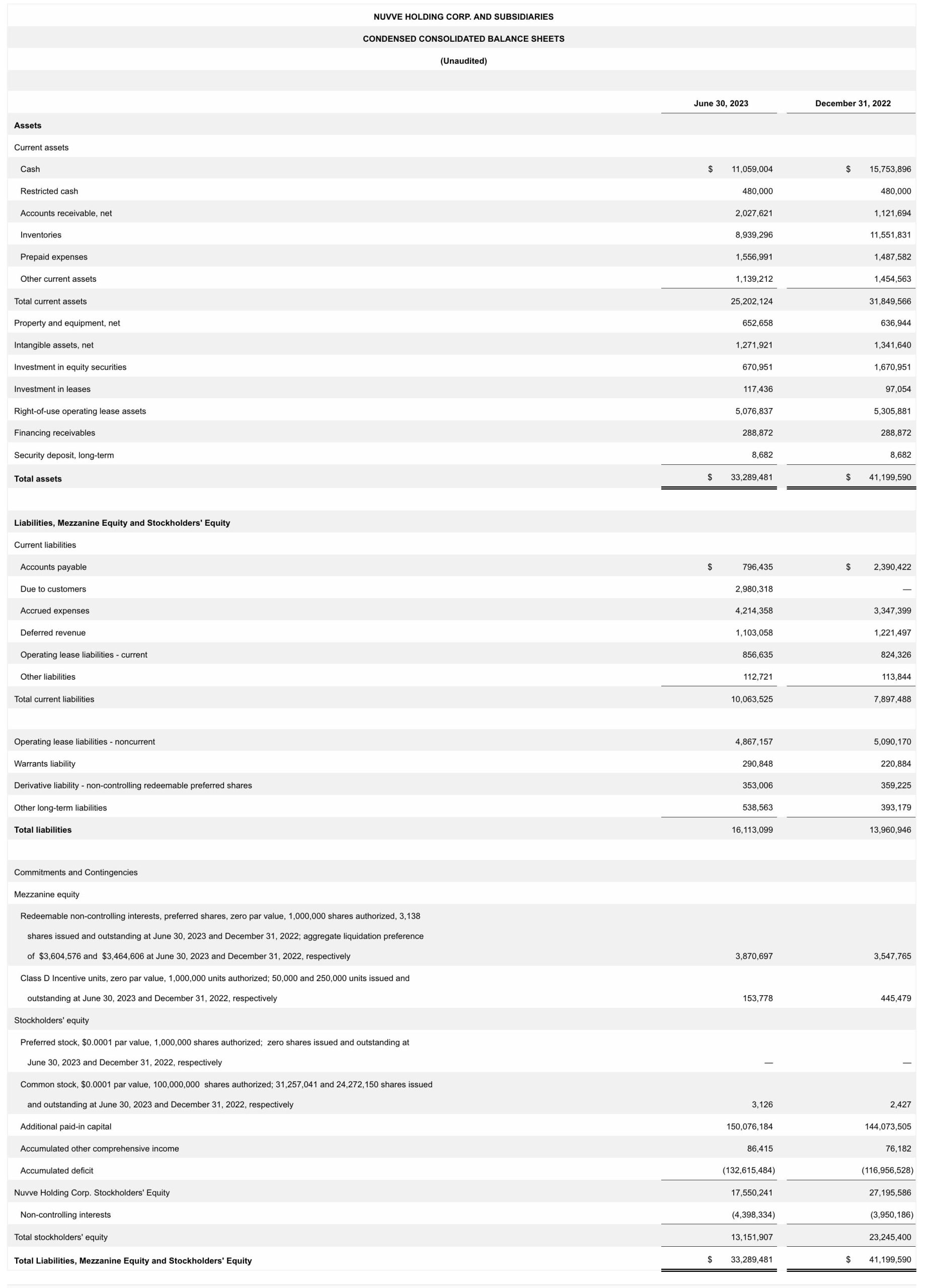

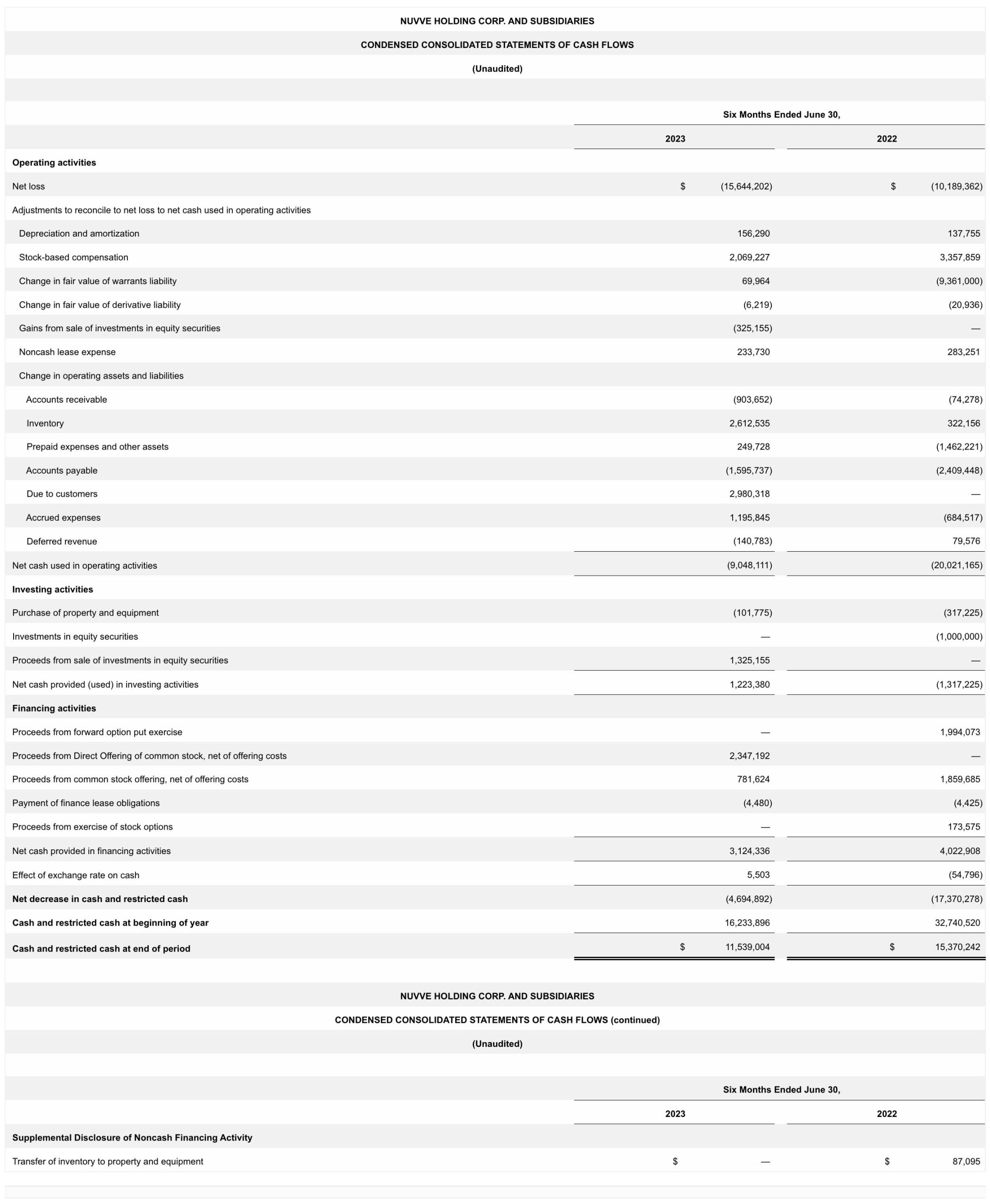

- Cash and cash equivalents of $11.1 million as of June 30, 2023

Management Discussion

Gregory Poilasne, Chief Executive Officer of Nuvve, said, “We are pleased to have achieved record orders for our DC Fast Chargers during the second quarter of 2023 – the second quarter in a row of record orders for Nuvve – driving a significant increase in our backlog. We came into 2023 with optimism that this year would mark an inflection point for our company, and so far, results across a variety of metrics have supported our optimism. Beyond our results, we have seen a significant increase in interest in our technology and our IP as well as our integrated solution. For example, we began to integrate our Astrea AI capabilities into our product offering, further enhancing the benefits we offer our end users. We also established Nuvve K-12, a dedicated division for school bus fleet electrification, to help customers cross the finish-line and successfully initiate what look to be increasingly bigger fleet electrification programs. Overall, visibility is gradually improving, and we expect to sustain momentum from the first half of the year in the second half.”

2023 Second Quarter Financial Review

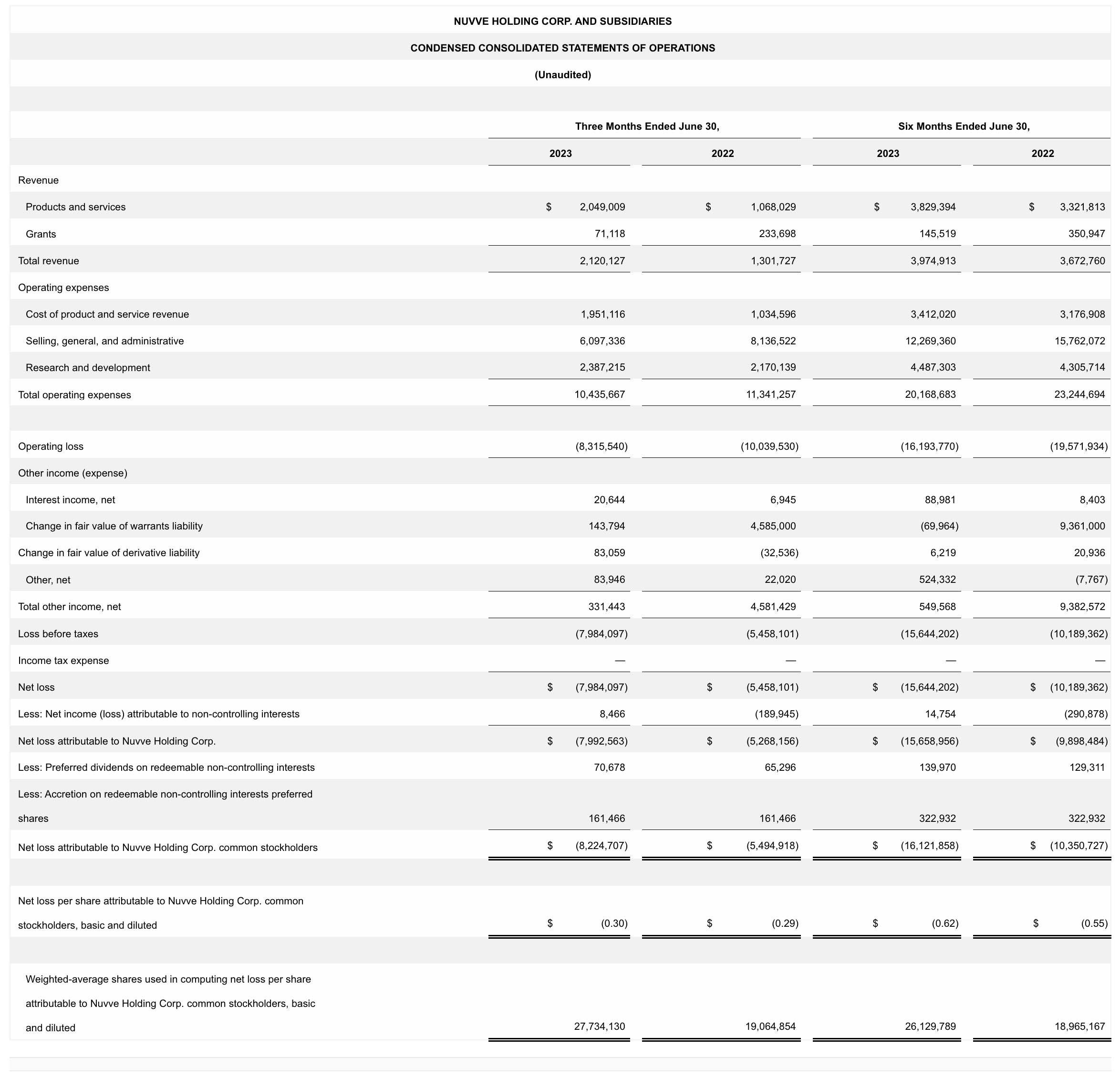

Total revenue was $2.1 million for the three months ended June 30, 2023, compared to $1.3 million for the three months ended June 30, 2022, an increase of $0.8 million, or 62.9%. The increase was primarily attributed to a $1.0 million increase in products and services revenue due to higher customers sales orders and shipments, partially offset by a decrease in grants of $0.16 million. Products and services revenue for the three months ended June 30, 2023, consisted of sales of DC and AC Chargers of about $1.54 million, grid services revenue of $0.09 million, and engineering services of $0.42 million.

Cost of products and services revenue for the three months ended June 30, 2023, increased by $0.92 million to $2.0 million compared to $1.0 million for the three months ended June 30, 2022 due to higher customers sales orders and shipments. Products and services margin increased to 4.8% for the three months ended June 30, 2023 compared to 3.1% in the same prior year period. Margin was mostly impacted by a higher mix of hardware charging stations sales offset by a lower mix of engineering services in the current quarter.

Selling, general and administrative expenses consist of selling, marketing, advertising, payroll, administrative, legal, finance, and professional expenses. Selling, general and administrative expenses were $6.1 million for the three months ended June 30, 2023, as compared to $8.1 million for the three months ended June 30, 2022, a decrease of $2.0 million, or 25.1%.

The decrease during the three months ended June 30, 2023 was primarily attributable to decreases in compensation expenses of $0.7 million, including share-based compensation, decreases in travel related expenses of $0.3 million, decreases in professional fees related to internal operational reviews of $0.9 million, decreases in governance and other public company costs of $0.4 million, decreases in insurance related expenses of $0.3 million, partially offset by increased in professional fees related to audit services of $0.6 million, and software subscription expenses of $0.2 million. Expenses resulting from the consolidation of Levo’s activities during the three months ended June 30, 2023, contributed $0.4 million to the decrease in selling, general and administrative expenses.

Research and development expenses increased by $0.2 million, or 10%, from $2.2 million for the three months ended June 30, 2022 to $2.4 million for the three months ended June 30, 2023. The increases during the three months ended June 30, 2023 was primarily attributable to increase in compensation expenses and subcontractor expenses used to advance the Company’s platform functionality and integration with more vehicles.

Other income (expense) consists primarily of interest expense, change in fair value of warrants liability and derivative liability, and other income (expense). Other income (expense) decreased by $4.2 million from $4.6 million of other income for the three months ended June 30, 2022, to $0.3 million in other income for the three months ended June 30, 2023. The decrease during the three months ended June 30, 2023 was primarily attributable to the change in fair value of the warrants liability and derivative liability.

In the three months ended June 30, 2023 and 2022, we recorded no material income tax expenses. The income tax expenses during the three months ended June 30, 2023 and 2022 were minimal primarily due to operating losses that receive no tax benefits as a result of a valuation allowance recorded for such losses.

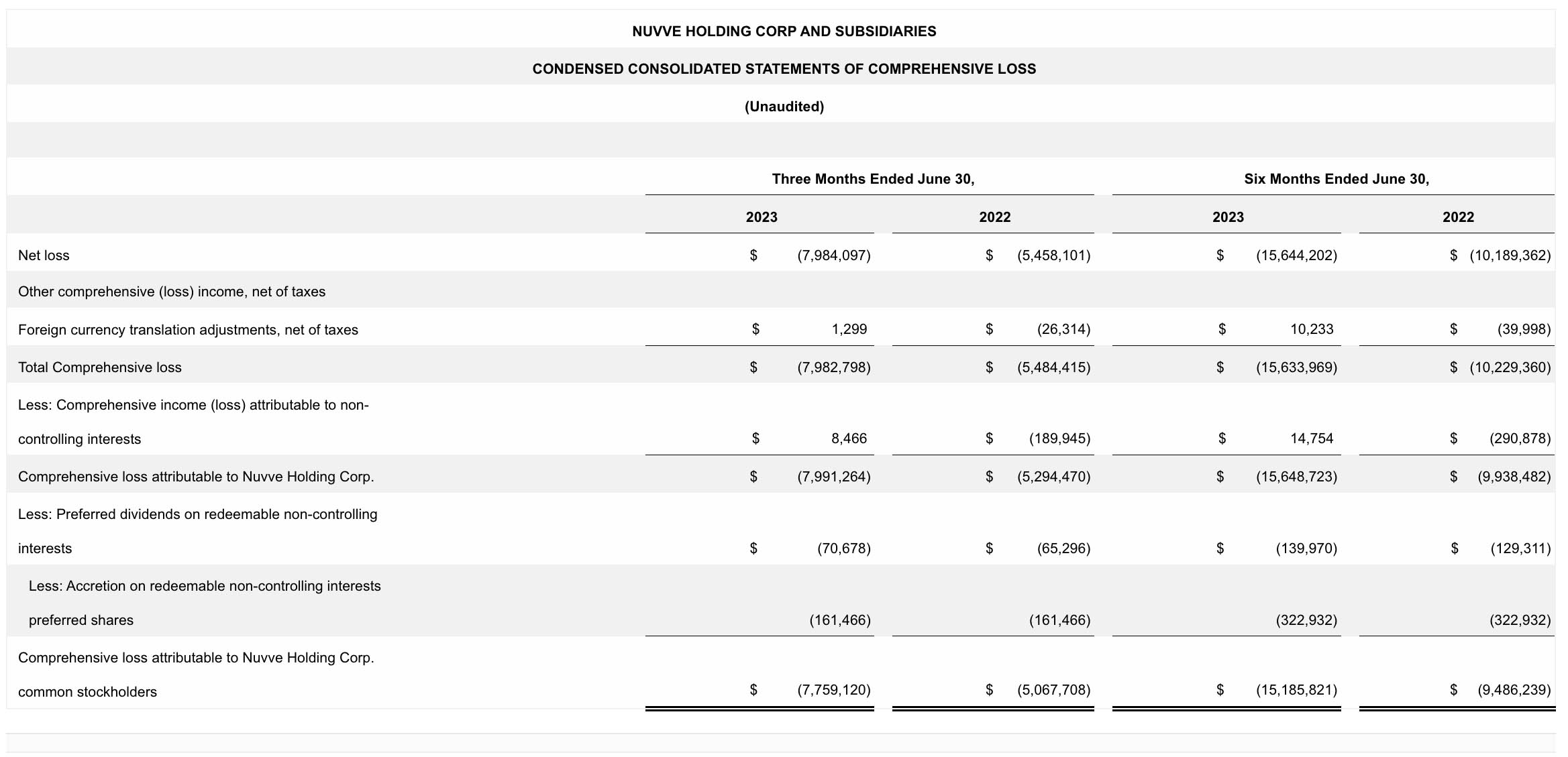

Net loss increased by $2.5 million, or 46.3%, from $5.5 million for the three months ended June 30, 2022, to $8.0 million for the three months ended June 30, 2023. The increase in net loss was primarily due to a decrease in other income of $4.2 million, partially offset by increase in revenue of $0.8 million, and a decrease in operating expenses of $0.9 million, for the aforementioned reasons.

Net Income (Loss) Attributable to Non-Controlling Interest

Net income attributable to non-controlling interest was $0.01 million for the three months ended June 30, 2023 compared to Net loss attributable to non-controlling interest of $0.19 million for the three months ended June 30, 2022.

Net income (loss) is allocated to non-controlling interests in proportion to the relative ownership interests of the holders of non-controlling interests in Levo, an entity formed by us with Stonepeak and Evolve. We own 51% of Levo’s common units and Stonepeak and Evolve own 49% of Levo’s common units. We have determined that Levo is a variable interest entity (“VIE”) in which we are the primary beneficiary. Accordingly, we consolidated Levo and recorded a non-controlling interest for the share of Levo owned by Stonepeak and Evolve during the three months ended June 30, 2023.

Conference Call Details

The Company will hold a conference call to review its financial results for the second quarter of 2023, along with other Company developments, at 5:00 PM Eastern Time (2:00 PM PT) today, Thursday, August 10, 2023.

To participate, please register for and listen via a live webcast, which is available in the ‘Events’ section of Nuvve’s investor relations website at https://investors.nuvve.com/. In addition, a replay of the call will be made available for future access.

ABOUT NUVVE HOLDING CORP.

Nuvve Holding Corp. (Nasdaq: NVVE) has developed a proprietary vehicle-to-grid (V2G) technology, including its Grid Integrated Vehicle (“GIVe™”) cloud-based software platform, that enables it to link multiple electric vehicle (“EV”) batteries into a virtual power plant to provide bi-directional energy to the electrical grid in a qualified and secure manner. Combining the world’s most advanced V2G technology and an ecosystem of electrification partners, Nuvve dynamically manages power among electric vehicle (EV) batteries and the grid to deliver new value to EV owners, accelerate the adoption of EVs, and support the world’s transition to clean energy. With products designed to transform EVs into mobile energy storage assets and networking battery capacity to support shifting energy needs, Nuvve is working toward making the grid more resilient, enhancing sustainable transportation, and supporting energy equity in an electrified world. Since its founding in 2010, Nuvve has successfully deployed V2G on five continents and offers turnkey electrification solutions for fleets of all types. Nuvve is headquartered in San Diego, California, and can be found online at nuvve.com.

Nuvve and associated logos are among the trademarks of Nuvve and/or its affiliates in the United States, certain other countries and/or the EU. Any other trademarks or trade names mentioned are the property of their respective owners.

Forward-Looking Statements

The information in this press release includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of present or historical fact included in this press release, regarding Nuvve and Nuvve’s strategy, future operations, estimated and projected financial performance, prospects, plans and objectives are forward-looking statements. When used in this press release, the words “could,” “should,” “will,” “may,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “project,” the negative of such terms and other similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. These forward-looking statements are based on management’s current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events. Except as otherwise required by applicable law, Nuvve disclaims any duty to update any forward-looking statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances after the date of this press release. Nuvve cautions you that these forward-looking statements are subject to numerous risks and uncertainties, most of which are difficult to predict and many of which are beyond the control of Nuvve. In addition, Nuvve cautions you that the forward-looking statements contained in this press release are subject to the following factors: (i) risks related to the rollout of Nuvve’s business and the timing of expected business milestones; (ii) Nuvve’s dependence on widespread acceptance and adoption of electric vehicles and increased installation of charging stations; (iii) Nuvve’s ability to maintain effective internal controls over financial reporting, including the remediation of identified material weaknesses in internal control over financial reporting relating to segregation of duties with respect to, and access controls to, its financial record keeping system, and Nuvve’s accounting staffing levels; (iv) Nuvve’s current dependence on sales of charging stations for most of its revenues; (v) overall demand for electric vehicle charging and the potential for reduced demand if governmental rebates, tax credits and other financial incentives are reduced, modified or eliminated or governmental mandates to increase the use of electric vehicles or decrease the use of vehicles powered by fossil fuels, either directly or indirectly through mandated limits on carbon emissions, are reduced, modified or eliminated; (vi) potential adverse effects on Nuvve’s backlog, revenue and gross margins if customers increasingly claim clean energy credits and, as a result, they are no longer available to be claimed by Nuvve; (vii) the effects of competition on Nuvve’s future business; (viii) risks related to Nuvve’s dependence on its intellectual property and the risk that Nuvve’s technology could have undetected defects or errors; (ix) the risk that we conduct a portion of our operations through a joint venture exposes us to risks and uncertainties, many of which are outside of our control; (x) that our joint venture with Levo Mobility LLC may fail to generate the expected financial results, and the return may be insufficient to justify our investment of effort and/or funds; (xi) changes in applicable laws or regulations; (xii) risks related to disruption of management time from ongoing business operations due to our joint ventures; (xiii) risks relating to privacy and data protection laws, privacy or data breaches, or the loss of data; (xiv) the possibility that Nuvve may be adversely affected by other economic, business, and/or competitive factors; (xv) risks related to the benefits expected from the $1.2 trillion dollar infrastructure bill passed by the U.S. House of Representatives (H.R. 3684); (xvi) risks related to investment strategies and third-party partnerships; (xvii) Nuvve’s identification and evaluation of business opportunities and its ability to capitalize on such opportunities, capture market share, or to expand its presence in certain markets; and (xviii) Nuvve’s ability to continue to grow its business, as well as other risks described in this Annual Report on Form 10-K and other factors described from time to time in our filings with the SEC. Should one or more of the risks or uncertainties described in this press release materialize or should underlying assumptions prove incorrect, actual results and plans could differ materially from those expressed in any forward-looking statements. Additional information concerning these and other factors that may impact the operations and projections discussed herein can be found in the Annual Report on Form 10-K filed by Nuvve with the Securities and Exchange Commission (SEC) on March 31, 2023, and in the other reports that Nuvve has, and will file from time to time with the SEC. Nuvve’s SEC filings are available publicly on the SEC’s website at www.sec.gov.

Use of Projections

This press release contains projected financial information with respect to Nuvve. Such projected financial information constitutes forward-looking information, and is for illustrative purposes only and should not be relied upon as necessarily being indicative of future results. The assumptions and estimates underlying such financial forecast information are inherently uncertain and are subject to a wide variety of significant business, economic, competitive and other risks and uncertainties. See “Forward-Looking Statements” above. Actual results may differ materially from the results contemplated by the financial forecast information contained in this press release, and the inclusion of such information in this press release should not be regarded as a representation by any person that the results reflected in such forecasts will be achieved.

Trademarks

This press release contains trademarks, service marks, trade names and copyrights of Nuvve and other companies, which are the property of their respective owners.

Nuvve Investor Contact

ICR Inc.

nuvve@icrinc.com, +1 646-200-8872

FINANCIAL TABLES FOLLOW

View original content to download multimedia: https://www.prnewswire.com/news-releases/nuvve-provides-second-quarter-2023-financial-update-301898257.html

SOURCE Nuvve Holding Corp.